Your Gold is worthless

Well, "worthless" might be too strong a term, but those of you who have wet dreams of trading/bartering with gold when and if the sh*t hits the fan might be in for a rude awakening.

Last month, in an interview on CNBC a VP for a London investment firm urged America and her immediate neighbors to drop their national currency and replace it with a Euro type "Amero". (www.worldnetdaily.com)

This was greeted with little fanfare except over conspiratorial web sites who have been chatting on this possibility for a while.

Recently WorldNetDaily has reported that the REAL U.S. shortfall is $4.6 Trillion-that's with a 'T 'as in 'Take them for all their worth", a modern-day version of a former queens suggestion that "they can eat cake".

"The 2006 federal budget deficit of $4.6 trillion is $1.1 trillion more than the 2005 federal budget deficit," econometrician John Williams, who publishes the website Shadow Government Statistics, told WND. "The Bush administration is in an untenable situation with a budget deficit this dramatic. Taxing 100 percent of all wages, salaries, and corporate profits would not eliminate a deficit of this magnitude, and cutting Social Security and Medicare spending is politically impossible."

In 1967, just a few years before President Nixon officially declared the US would not honor their dollar-Gold commitments to foreign nations, an up and rising economic star named Alan Greenspan said this:

"In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. If everyone decided, for example, to convert all his bank deposits to silver or copper or any other good, and thereafter declined to accept checks as payment for goods, bank deposits would lose their purchasing power and government-created bank credit would be worthless as a claim on goods. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves.

This is the shabby secret of the welfare statists' tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard."

Gold restrictions in current history:

As part of this process, many nations, including the U.S., banned private ownership of gold either de jure or de facto. In the United States Franklin Delano Roosevelt using the Trading With the Enemy Act for statutory authority to abrogate gold and silver clauses in U.S. Securities and impose fines of up to $100,000,000 on those who refused to do so. Over this period FDR passed two laws prohibiting U.S. citizens and the Federal Reserve ownership of gold, Executive Order 6102 of 1933 and the Gold Reserve Act of 1934. Jewelry, private coin collections, and the like were exempt from this ban, which in any case seems not to have been enforced too zealously. In 1975 all restrictions on the right of American citizens to own gold were abolished.

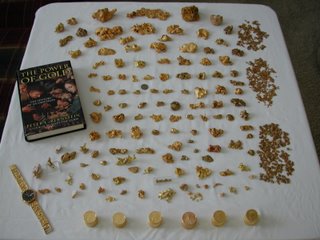

Dr. Chris Marenson stated on his site on December 17, 2006 that the US is insolvent. He states that our combined federal deficits now total more than 400% of GDP. (GDP is the value of all the services and final goods made in the US each year.) Dr. Marenson is also an advocate of buying Gold and Silver along with multitudes of others . I daresay the current amount of precious metals actually being held by Americans in the last few years has increased dramatically which brings me to my point.

In the event that the U.S. has a currency crisis and the suggestions from the powers that be become stronger and stronger for adapting a North American Euro type dollar, I suggest that it would be in their best interest to make sure that new dollar has some meat behind it: Gold & Silver.

Now where do you think they would get it from? From YOU.

The "authorities" did it once just a few years ago, and it is my humble opinion that it is going to happen again-and soon.

For those of you who believe you can "hide" your gold under your mattress and barter for necessities such as food and services I must suggest that you rethink your vision.

In an economic crisis such as this-IF it happens- would make the have nots and have lots stand out like sore thumbs. It would be in the authorities interest to hand out "finder rewards" to those who turn in their fellow citizens attempting to purchase items with gold and screw those holders of said metals to the wall-publicaly-by confiscating ALL they have and imposing vast fines/prison terms on their persons. After all, having gold is not practical unless you are able to purchase items you need to have with it.

I suggest a near term announcement by the 'authorities' to mandate a citizen liquidation of all precious metals and payments (in new dollars) of half of what they are worth on the open market. To those who refuse, there would be massive penalties. Do you think your stock portfolio full of gold bullion will be safe from confiscation? Do you think your purchases of metals from your checking/credit card accounts will not be noticed?

My apologies, but the drummers of Gold and Silver hoarding-even though they have (ironically)- hit the nail on the head- will not benefit from a crisis that many think are only years away from happening.

Unless you are one of the ultra wealthy, and most who visit blogs are not-you are as much a part of the 'system' as I am, and are able-as I am - to be manipulated within the system to the benefit of the people who run the system.

credits:

http://www.goldfeverprospecting.com/gogapi.html

http://www.usagold.com

http://en.wikipedia.org/wiki/Gold_standard

http://drmss.com/wordpress/

10 Comments:

Many people ar willing to turn a blind eye to the coming insolvency of the US, as well as the plan for the amero, which is also on the way. The corpocracy which controls our government seems more concerned with covering their assets than doing any corrective measures to prevent the inevitable collpase of the dollar.

collpase of the dollar?

Lew, ol boy, have you took to imbibing a little of the New Years Cheer a bit early?

Next thing we know you'll be talking about UFO cover ups....

Well I dont know about collapse, but its strength is inflated, its exchange in China is rigged, and its backed in ...promises.

Aj I keep hoping to see you, and wanted to wish you a happy new year, etc. We miss your wit and especially your conspiracies. I hope you can come by sometime. In any case I am glad to see you posting. I was reading a site the other day about all of the reasons to invest NOW in gold. Really pushing the idea. I had some issues with the assertions, but do agree that the dollar will become devalued.

The sure thing when the shit hits the fan??? AMMO of course. Ammo will always have value. It can be used to protect you in an apocalyptic crisis and can be bartered for supplies.

What good is gold? Cant eat it. Cant defend your home with it.

Nope- I'm for ammo. Thats my input.

Miss you AJ!!!

Hey Lily, are you taking care of Lew? He seemed to have tied one on the other day..

Yes Ammo, might be a good idea if you can keep the evidence of gun ownership from the authorities if they come knocking at your door requesting any weapons 'temporarily' until order is restored...pvzjt

"confiscation through inflation"

greenspan called the game right there.

we are but slaves in this technocracy.

Must see:

"The Money Masters"

http://video.google.com/videoplay?docid=-515319560256183936&q=the+money+masters&total=677&start=0&num=10&so=0&type=search&plindex=0

Gold is for the merchant -- silver for the maid --

Copper for the craftsman cunning at his trade.

"Good!" said the Baron, sitting in his hall,

"But Iron -- Cold Iron -- is master of them all."

I'd buy steel and iron instead of gold. It's used in industry, infinitly divisable, lighter per cubic inch than gold too. Easily stored, and I don't think it will come to mind to the government to sieze it.

Yeah, that $300 an ounce gold in 2006 is sure to be a worthless $1400 by 2010. The problem isn't that gold is worth more or less, it's that the price of everything else goes up an' down from it.

If you don't see the economic smokescreen in the price of anything today (lending rates, DJIA, etc) just look at the same data in ounces of gold rather than US dollars.

"Yeah, that $300 an ounce gold in 2006 is sure to be a worthless $1400 by 2010. The problem isn't that gold is worth more or less, it's that the price of everything else goes up an' down from it."

Gosh, you're a prophet! It really is $1400 right now.

Of course he was right, because he knew he was dealing with gold-hypnotized idiots, and he could do the math from there. Using the same fantasy fool public template, I can likewise do even better "predicting" than he did - gold will be $5,000 an ounce by 2020. So what? It will still be WORTHLESS by the exact SAME amount: 100%! Gold is garbage. Every apocalypse ape grabbing gold should also get a tin foil hat to go with it.

Post a Comment

<< Home